TLDR

Insurance CRM is a comprehensive customer relationship management solution tailored for insurance agents and brokers.

- Why Insurance Agents Need CRM

- Manage client relationships and policy details in one place

- Improve retention with timely follow-ups and renewal tracking

- Stay compliant with organized, audit-ready documentation

Key Benefits

- Boost productivity with automation and task prioritization

- Increase sales through segmentation and upsell opportunities

- Deliver personalized service with centralized data access

Essential Features

- Policy & client segmentation tools

- Automated renewal alerts and reminders

- Sales pipeline visualization and forecasting

- Marketing automation (emails, landing pages, campaigns)

- Mobile access and integrations with calendars & email

Act! is a scalable, affordable CRM solution that combines sales, marketing, and customer service tools to help insurance professionals grow their business and deliver personalized service.

While getting insured is an important financial practice, the majority of consumers don’t select their insurance providers based on price or coverage alone. In fact, a whopping 46 percent of consumers say customer experience (CX) is the top factor they consider when choosing an insurance provider. Yet, the insurance industry faces a significant CX challenge. The top issue that 42 percent of insureds confront when interacting with insurers is communication. Couple this with stretched sales processes and increasing competition, and you have a CX problem on your hands. But don’t worry, there’s a solution that can help: an insurance CRM (customer relationship management) platform.

In this guide, we’ll explore what a CRM for insurance is and how it can help you manage policyholders, streamline insurance workflows, and deliver personalized service. Whether you’re looking to improve communication, streamline renewals, or simply stand out in a crowded market, an insurance CRM platform can make a big difference. So let’s dive in!

What is insurance CRM?

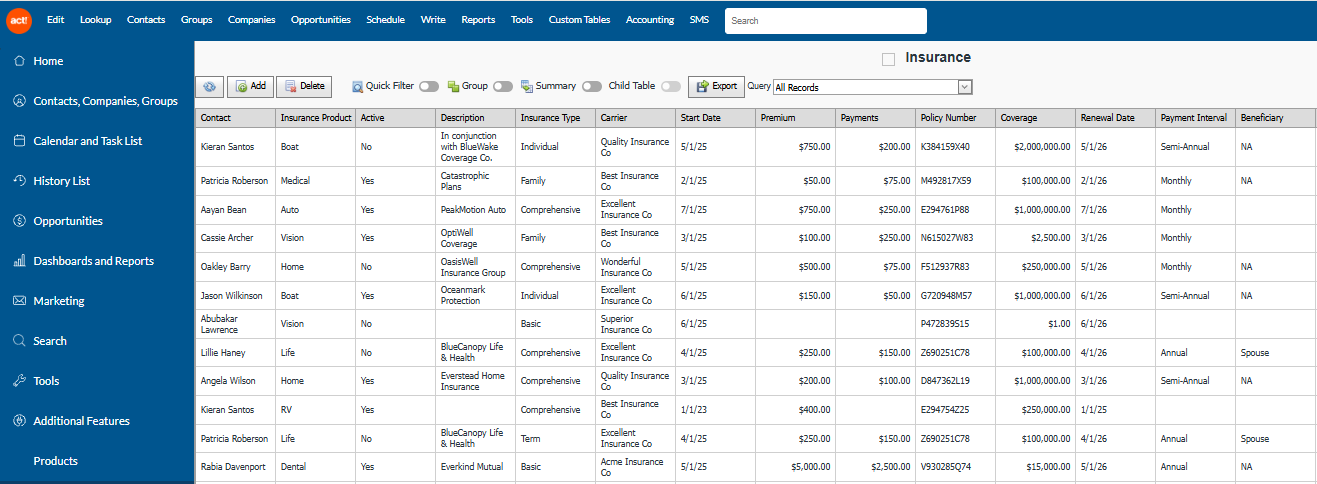

An insurance agent CRM is a platform that enables insurance companies to manage their communication and relationships with prospects and customers and gain a competitive edge. Today’s insurance agents use a CRM for:

Client & Policy Segmentation:

- Agents can segment customers by line of business (e.g., commercial, personal, life).

- Segmentation helps identify cross-sell opportunities and improves policy organization.

- Supports bundled policy visibility — 77% of customers prefer bundling insurance products.

Renewal & Expiration Management:

- Automated alerts for upcoming policy renewals, even 6+ months in advance.

- Enables proactive outreach and higher renewal rates.

- Reduces lapsed coverage and improves client trust.

Audit-Ready Information Access:

- Centralized client profiles simplify regulatory compliance and documentation.

- Searchable records help resolve client issues quickly and efficiently.

Streamlined Workflows & Data Access:

- CRM functionality brings policy & contact data into one system, cutting navigation time to under three clicks .

- Eliminates repetitive data entry, reducing errors and freeing agents to focus on advisory work.

Why CRM is important for insurance agents

Based on the survey results noted above, insurance agents clearly have some ground to cover to improve customer experience, and that’s where an insurance agency CRM comes in handy. A CRM is important in insurance because it enables agents to see all customer interactions on a single portal and respond to them quickly.

Plus, your agents get access to a customer’s profile and interaction history. This can help them better personalize their communication and offerings to get them to convert.

In a nutshell, an insurance CRM software solution gives agents the insights they need to better serve customers. It also helps them manage multiple customers and leads—all while delivering a top-notch customer experience through automation and personalization.

Download this free guide to learn how CRM and Marketing Automation can help your insurance business provide stellar customer experiences and outpace the competition.

Key features & benefits of insurance CRM

Now that we’ve explored the importance of CRMs in insurance, let’s take a look at some of the major features of insurance CRM tools and how they can help you scale your insurance business while making your agents’ lives easier.

1. Centralized customer data

CRMs bring all your customer and prospect communication under one roof. Whether it’s phone calls, emails, notes, or other policy documents, you can find all data related to the customer without having to scour loads of files.

As a result, you can easily see the history of the customer’s interactions and personalize your offerings for them. Additionally, you can segment individual clients based on their coverage types and policies so your agents can quickly retrieve information about specific policies. Ultimately, this allows you to offer better, more targeted solutions for improved customer satisfaction.

Centralized customer data enables you and your insurance agents to easily access key customer information remotely so you can convert prospects, even on the move.

2. Sales pipeline management

CRMs also help you with the sales process. As your sales reps have all the details they need about a lead at their fingertips, they can smoothly drive the conversation forward and move them closer to conversion.

Additionally, CRMs like Act! give you a detailed look into your sales pipeline. By visualizing your sales funnel, you can figure out the stages where your leads are dropping off and take corrective actions.

You can also take a dive deep into your sales pipeline by filtering it for location, sales stage, product, and more. This helps you get detailed insights into the more important customer segments to drive more conversions. Such granular insights help increase conversions and minimize expenses as you focus your efforts on prospects who are likely to convert.

3. Marketing campaign personalization

Using a CRM, insurers can also drive their marketing efforts. Armed with data on your customers, you can send out personalized email marketing campaigns that help you drive conversions. These insights can also help you engage your existing customers, reducing churn and increasing your customer lifetime value (CLV) through upsells and cross-sells.

Most CRMs with integrated marketing automation allow you to build landing pages and web forms to drive your lead-generation efforts. These can help you attract inbound leads, which you can then nurture to drive more insurance policy renewals and sales.

4. Workflow automation

Automation can reduce your workload dramatically by eliminating the need to do repetitive tasks. It can even help you engage better with your customers. For instance, many prominent CRMs offer automation features such as email campaign automation, which helps you send targeted, personalized emails to your prospects and customers based on their actions.

You can even send ad-hoc email blasts or trigger-based emails to prospects by leveraging email templates and social sharing features to supercharge your marketing efforts. For instance, with an integrated CRM and marketing automation solution, you can send renewal and expiration notices automatically.

And, automation features also extend to the CRM workflow and automate lead scoring so you can prioritize the leads that are likely to convert. Additionally, this integration lets you easily assign actions based on customer engagement so you and your insurance agents know exactly what needs to be done.

5. Analytics

Analytics is another essential feature of any insurance CRM. The best insurance agency CRMs give you in-depth insights into your agents’ performance and show you where your marketing and sales strategies are taking the agency They also give you an idea of how well you’re retaining your existing customers with renewals.

For instance, a built-in dashboard shows real-time analytics with metrics that help you track your business and insurance agent performance. The real-time insights into marketing and sales can nudge you to take steps to drive more policy sales and boost business growth.

Additionally, dashboards with real-time insights show your business health over a certain period, while providing projections for future performance based on past metrics. These simple metrics can help you take steps to improve business health.

Some of the other key metrics you can track include:

- Revenue vs. costs

- Average number of days in a stage

- Reasons for opportunities you’ve lost

- Won vs. lost sales

- Forecasted sales (by product and agents)

- Individual insurance agent activities

6. Task prioritization

Tracking your interactions with a handful of customers as a single-person sales team may work manually. However, the process gets complicated when you have multiple insurance agents dealing with hundreds of customers at once. Manual follow-ups and appointment tracking might lead to missed appointments, which could mean a drop in sales.

An insurance CRM helps you create a list of tasks sorted by priority so you and your insurance agents always know what they need to take up next during their workday. Additionally, it provides notifications and alerts for key tasks. This ensures that your agents don’t miss out on any important follow-ups that might have led to prospects dropping out of your sales funnel.

7. Integrations with other tools

You might use several platforms to connect with your customers and drive your business operations. From email to messaging tools and calendars, you may have numerous existing tools in your tech stack.

CRMs can help streamline your business processes across these tools by effectively integrating with them. Not only does this eliminate the need to switch between different tools to get the job done, but it also helps extend the functionality of your CRM.

For example, most CRMs seamlessly integrate with your calendar and email so you can keep tabs on all your conversations and appointments from within the platform. The CRM will notify your insurance agents of any upcoming appointments or follow-ups so they never miss out on them.

Additionally, CRM integrates with social media, communication, sales, e-commerce, accounting, and customer service tools.

From viewing your e-commerce platform’s order history to adding new contacts whenever you get new followers on Instagram, the integrations automate important functions that can drive your insurance business forward.

Choosing the right CRM for your insurance agency

With the key features of an insurance CRM in mind, how can you zero in on the right one for your insurance agency? Follow these steps to evaluate the CRMs you consider.

1. Define your needs and budget

First things first—you must identify what you aim to achieve by using your CRM. List down the features you want so you can filter out CRMs that don’t offer them. At the same time, determine your budget for the CRM platform and check its pricing.

2. Check your existing tech stack

The CRM you choose should integrate with your existing tech stack to streamline your workflow and eliminate the need to juggle between multiple platforms. At the same time, the integrations will help with better lead generation and follow-ups. For instance, connecting your CRM with Slack will enable you to send notifications between the platforms.

3. Look for lead-management features

Managing multiple leads manually can quickly get overwhelming for your insurance agents. That’s why you must consider a CRM’s lead-management features. Check how it can help you track leads, manage their interactions, and view prospect history.

4. Consider automation

Another aspect worth checking when considering a CRM is its automation capabilities. The CRM should automate your workflows so you can easily get in touch with customers and prospects.

It also helps if it offers marketing and sales automation features like email campaigns, landing pages, and form builders. For instance, many all-in-one CRMs offer email campaigns, automated CRM workflow and lead scoring, and landing page builders, among other things.

5. Scalability

As your insurance agency grows, so will your requirements. You’ll have a bigger customer base to cater to and the CRM you choose should offer enough scalability to support this business growth. This is where cloud-based CRMs come in handy. You can keep adding users as your business scales without worrying about losing any client data or hitting a tool capacity ceiling.

6. Reporting and analytics

The CRM platform you choose must offer superior reporting and analytics features. This helps you identify where your marketing and sales strategies are going so you can tweak your approach and improve your revenue from insurance policy sales.

With the right CRM, you can leverage in-depth insights into your sales funnel and advanced forecasting features to help you figure out if your strategy will yield better results in the future.

7. Mobile apps

Smartphone apps are a must for insurance CRMs. They help insurance agents access customer details and follow up with prospects even when they’re on the move so your agency can advance sales opportunities without bringing everyone back to the office.

Many mobile apps provide driving and destination maps, access to customer details, real-time metrics, and hot leads—all in one application. You’ll want to confirm that the app is available on both Android and iOS or whichever you use.

Scale your insurance agency with the right CRM

In the insurance sector, customers demand superior service. The only way to ensure it’s done right is to connect with them on time with personalized assistance. A CRM can help your agents understand customers better and deliver services faster. It can also play a pivotal role in driving new sales with automatic lead scoring and funnel analysis.

Act! CRM offers all these features and pairs them with marketing automation in one powerful platform you can use to scale your insurance agency. Get started now for free to see it in action.

Ready to leverage the power of CRM and Marketing Automation in your insurance business?

Manage Clients and Policies with Confidence.

CRM for insurance FAQs

An insurance agency management system is a platform that can help you manage the operations of your insurance agency. It helps you organize your book of business, enables agents to connect with each other, and can be tailored to the type of insurance your agency sells.

A CRM platform helps your agents connect with leads and advance them through your sales funnel. It also enables you to provide personalized service to existing customers to improve their experience.

In simple terms, an insurance CRM is a platform that insurance brokers and agencies can use to serve their leads and customers. It plays a critical role in managing client relationships and also aids in sales and marketing.

Want to learn more? Check out these related resources:

Videos

Articles

Guides

See what Map Insurance has to say about Act!